Innovative Insurance Models for High-Roller Credit Management

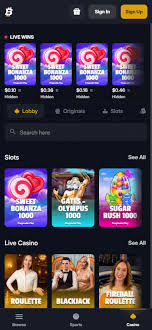

In the world of finance, managing high-roller credit is a delicate balance between maximizing potential returns and mitigating associated risks. For financial institutions that cater to high-net-worth clients, developing robust insurance models is crucial to protect against default, fraud, and other unforeseen circumstances. This article delves into the various strategies and models that can effectively manage high-roller credit risk, ensuring both lenders and borrowers benefit from secured transactions. To explore more on gaming and finance, check out Insurance Models for High-Roller Credit Bitfortune iOS.

Understanding High-Roller Credit

High-roller credit typically refers to credit extended to high-net-worth individuals or entities that possess significant assets and a substantial income. These clients often require customized financial products that align with their sophisticated investment strategies and unique financial needs. While high-roller lending can offer lucrative returns for lenders, the associated risks necessitate advanced insurance models to protect against potential losses.

The Risks Involved

High-roller credit comes with various risks, including:

- Credit Risk: The risk of borrower default is inherently higher among high-rollers, especially if they engage with volatile investment practices.

- Market Risk: Fluctuating market conditions can adversely impact the ability of high-net-worth individuals to meet their credit obligations.

- Fraud Risk: Instances of fraud can occur, particularly in complex financial transactions involving large sums of money.

- Operational Risk: Inefficiencies in managing high-roller accounts may lead to increased operational costs and potential losses.

Insurance Models to Mitigate Risks

To address these risks, financial institutions can employ several innovative insurance models:

1. Credit Default Insurance (CDI)

Credit default insurance protects lenders against the risk of borrower default. In this model, the lender pays a premium to an insurer who, in turn, agrees to cover the losses incurred due to non-payment. The structure of CDI is particularly suitable for high-roller clients, as it allows lenders to extend credit while minimizing their exposure to risk.

2. Performance Bonds

These bonds serve as a guarantee that the borrower will fulfill their obligations. If the borrower defaults, the bond provider compensates the lender, ensuring continued security for credit extended to high-rollers. Performance bonds can be particularly effective in safeguarding loans for high-stakes investments.

3. Parametric Insurance

This innovative insurance model pays out claims based on predetermined triggers rather than traditional assessments of loss. For instance, if a high-roller’s investment portfolio falls below a specific threshold, the insurance payout is automatically triggered. This model simplifies the claims process and ensures prompt compensation, which is crucial for high-net-worth individuals who may require immediate liquidity.

4. Collateralized Lending

In this model, the borrower provides collateral, such as real estate or securities, which can be liquidated in case of default. This not only lowers the risk for lenders but also allows high-rollers to leverage their assets for credit. Insurers can provide coverage for collateralized loans to protect against fluctuations in asset values.

The Role of Data Analytics

Advanced data analytics plays a pivotal role in developing and refining insurance models for high-roller credit. Financial institutions can leverage big data to assess the creditworthiness of high-net-worth individuals more accurately. By analyzing historical data and applying predictive analytics, lenders can make informed decisions about extending credit limits and determining appropriate insurance premiums.

Regulatory Considerations

In an ever-evolving regulatory landscape, financial institutions must ensure compliance with legal standards when implementing insurance models. This includes adhering to regulations concerning credit risk, consumer protection, and data privacy. Ongoing dialogue with regulatory bodies helps institutions remain proactive and align their practices with industry standards.

Client Education and Transparency

To foster stronger relationships with high-roller clients, institutions must prioritize education and transparency. Providing clients with in-depth information about insurance models and the associated risks can help them make informed financial decisions. Financial advisors should focus on explaining the benefits of various insurance products while addressing any concerns high-net-worth individuals may have.

Conclusion

The need for effective insurance models tailored to high-roller credit management is undeniable in a landscape marked by growing financial complexities. By embracing innovative insurance solutions and leveraging advanced analytics, financial institutions can mitigate risks associated with high-net-worth clients while enhancing their competitive edge. As the industry continues to evolve, the focus should remain on securing the financial future of both lenders and their clientele.

Write a comment